Deep learning has been widely applied in computer vision, natural language processing, and audio-visual recognition. The overwhelming success of deep learning as a data processing technique has sparked the interest of the research community. Given the proliferation of Fintech in recent years, the use of deep learning in finance and banking services has become prevalent. However, a detailed survey of the applications of deep learning in finance and banking is lacking in the existing literature. This study surveys and analyzes the literature on the application of deep learning models in the key finance and banking domains to provide a systematic evaluation of the model preprocessing, input data, and model evaluation. Finally, we discuss three aspects that could affect the outcomes of financial deep learning models. This study provides academics and practitioners with insight and direction on the state-of-the-art of the application of deep learning models in finance and banking.

Deep learning (DL) is an advanced technique of machine learning (ML) based on artificial neural network (NN) algorithms. As a promising branch of artificial intelligence, DL has attracted great attention in recent years. Compared with conventional ML techniques such as support vector machine (SVM) and k-nearest neighbors (kNN), DL possesses advantages of the unsupervised feature learning, a strong capability of generalization, and a robust training power for big data. Currently, DL has been applied comprehensively in classification and prediction tasks, computer visions, image processing, and audio-visual recognition (Chai and Li 2019). Although DL was developed in the field of computer science, its applications have penetrated diversified fields such as medicine, neuroscience, physics and astronomy, finance and banking (F&B), and operations management (Chai et al. 2013; Chai and Ngai 2020). The existing literature lacks a good overview of DL applications in F&B fields. This study attempts to bridge this gap.

While DL is the focus of computer vision (e.g., Elad and Aharon 2006; Guo et al. 2016) and natural language processing (e.g., Collobert et al. 2011) in the mainstream, DL applications in F&B are developing rapidly. Shravan and Vadlamani (2016) investigated the tools of text mining for F&B domains. They examined the representative ML algorithms, including SVM, kNN, genetic algorithm (GA), and AdaBoost. Butaru et al. (2016) compared performances of DL algorithms, including random forests, decision trees, and regularized logistic regression. They found that random forests gained the highest classification accuracy in the delinquency status.

Cavalcante et al. (2016) summarized the literature published from 2009 to 2015. They analyzed DL models, including multi-layer perceptron (MLP) (a fast library for approximate nearest neighbors), Chebyshev functional link artificial NN, and adaptive weighting NN. Although the study constructed a prediction framework in financial trading, some notable DL techniques such as long short-term memory (LSTM) and reinforcement learning (RL) models are neglect. Thus, the framework cannot ascertain the optimal model in a specific condition.

The reviews of the existing literature are either incomplete or outdated. However, our study provides a comprehensive and state-of-the-art review that could capture the relationships between typical DL models and various F&B domains. We identified critical conditions to limit our collection of articles. We employed academic databases in Science Direct, Springer-Link Journal, IEEE Xplore, Emerald, JSTOR, ProQuest Database, EBSCOhost Research Databases, Academic Search Premier, World Scientific Net, and Google Scholar to search for articles. We used two groups of keywords for our search. One group is related to the DL, including “deep learning,” “neural network,” “convolutional neural networks” (CNN), “recurrent neural network” (RNN), “LSTM,” and “RL.” The other group is related to finance, including “finance,” “market risk,” “stock risk,” “credit risk,” “stock market,” and “banking.” It is important to conduct cross searches between computer-science-related and finance-related literature. Our survey exclusively focuses on the financial application of DL models rather than other DL models like SVM, kNN, or random forest. The time range of our review was set between 2014 and 2018. In this stage, we collected more than 150 articles after cross-searching. We carefully reviewd each article and considered whether it is worthy of entering our pool of articles for review. We removed the articles if they are not from reputable journals or top professional conferences. Moreover, articles were discarded if the details of financial DL models presented were not clarified. Thus, 40 articles were selected for this review eventually.

This study contributes to the literature in the following ways. First, we systematically review the state-of-the-art applications of DL in F&B fields. Second, we summarize multiple DL models regarding specified F&B domains and identify the optimal DL model of various application scenarios. Our analyses rely on the data processing methods of DL models, including preprocessing, input data, and evaluation rules. Third, our review attempts to bridge the technological and application levels of DL and F&B, respectively. We recognize the features of various DL models and highlight their feasibility toward different F&B domains. The penetration of DL into F&B is an emerging trend. Researchers and financial analysts should know the feasibilities of particular DL models toward a specified financial domain. They usually face difficulties due to the lack of connections between core financial domains and numerous DL models. This study will fill this literature gap and guide financial analysts.

The rest of this paper is organized as follows. Section 2 provides a background of DL techniques. Section 3 introduces our research framework and methodology. Section 4 analyzes the established DL models. Section 5 analyzes key methods of data processing, including data preprocessing and data inputs. Section 6 captures appeared criteria for evaluating the performance of DL models. Section 7 provides a general comparison of DL models against identified F&B domains. Section 8 discusses the influencing factors in the performance of financial DL models. Section 9 concludes and outlines the scope for promising future studies.

Regarding DL, the term “deep” presents the multiple layers that exist in the network. The history of DL can be traced back to stochastic gradient descent in 1952, which is employed for an optimization problem. The bottleneck of DL at that time was the limit of computer hardware, as it was very time-consuming for computers to process the data. Today, DL is booming with the developments of graphics processing units (GPUs), dataset storage and processing, distributed systems, and software such as Tensor Flow. This section briefly reviews the basic concept of DL, including NN and deep neural network (DNN). All of these models have greatly contributed to the applications in F&B.

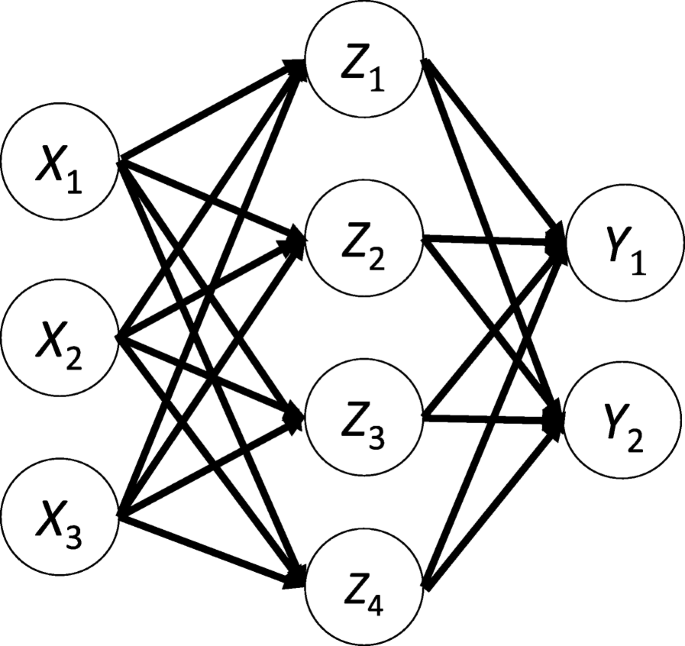

The basic structure of NN can be illustrated as Y = F(X T w + c) regarding the independent (input) variables X, the weight terms w, and the constant terms c. Y is the dependent variable and X is formed as an n × m matrix for the number of training sample n and the number of input variables m. To apply this structure in finance, Y can be considered as the price of next term, the credit risk level of clients, or the return rate of a portfolio. F is an activation function that is unique and different from regression models. F is usually formulated as sigmoid functions and tanh functions. Other functions can also be used, including ReLU functions, identity functions, binary step functions, ArcTan functions, ArcSinh functions, ISRU functions, ISRLU functions, and SQNL functions. If we combine several perceptrons in each layer and add a hidden layer from Z1 to Z4 in the middle, we term a single layer as a neural network, where the input layers are the Xs, and the output layers are the Ys. In finance, Y can be considered as the stock price. Moreover, multiple Ys are also applicable; for instance, fund managers often care about future prices and fluctuations. Figure 1 illustrates the basic structure.

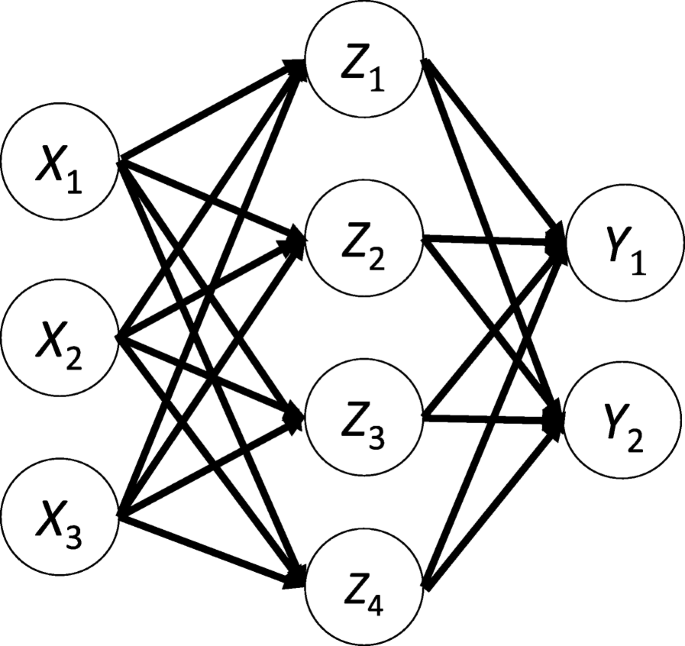

Based on the basic structure of NN shown in Fig. 1, traditional networks include DNN, backpropagation (BP), MLP, and feedforward neural network (FNN). Using these models can ignore the order of data and the significance of time. As shown in Fig. 2, RNN has a new NN structure that can address the issues of long-term dependence and the order between input variables. As financial data in time series are very common, uncovering hidden correlations is critical in the real world. RNN can be better at solving this problem, as compared to other moving average (MA) methods that have been frequently adopted before. A detailed structure of RNN for a sequence over time is shown in Part B of the Appendix (see Fig. 7 in Appendix).

Although RNN can resolve the issue of time-series order, the issue of long-term dependencies remains. It is difficult to find the optimal weight for long-term data. LSTM, as a type of RNN, added a gated cell to overcome long-term dependencies by combining different activation functions (e.g., sigmoid or tanh). Given that LSTM is frequently used for forecasting in the finance literature, we extract LSTM from RNN models and name other structures of standard RNN as RNN(O).

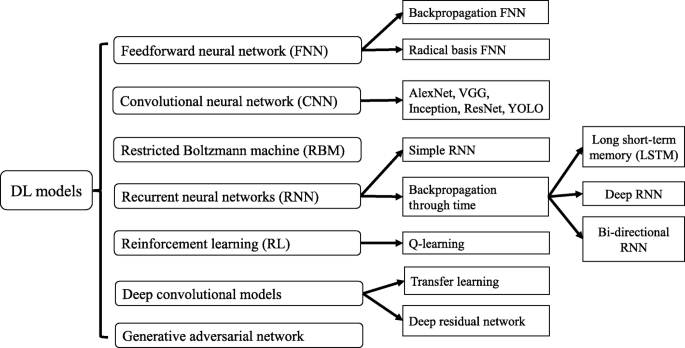

As we focus on the application rather than theoretical DL aspect, this study will not consider other popular DL algorithms, including CNN and RL, as well as Latent variable models such as variational autoencoders and generative adversarial network. Table 6 in Appendix shows a legend note to explain the abbreviations used in this paper. We summarize the relationship between commonly used DL models in Fig. 3.

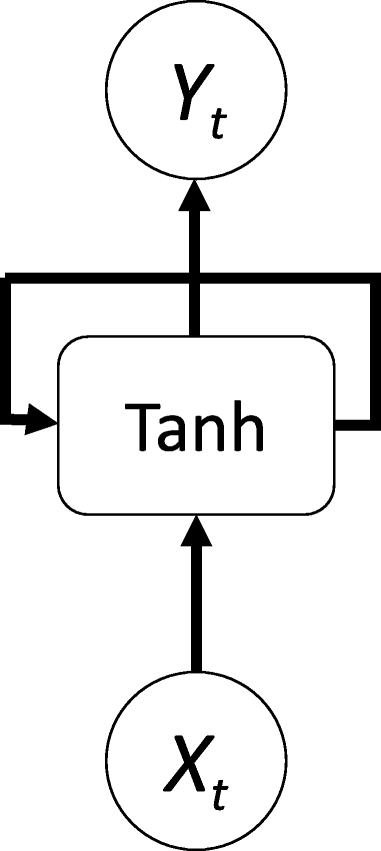

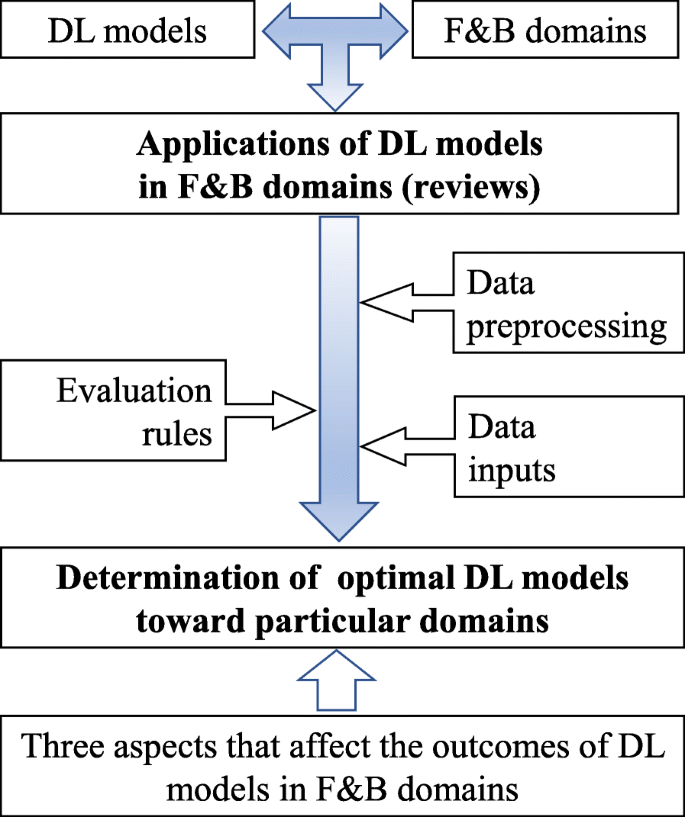

Our research framework is illustrated in Fig. 4. We combine qualitative and quantitative analyses of the articles in this study. Based on our review, we recognize and identify seven core F&B domains, as shown in Fig. 5. To connect the DL side and the F&B side, we present our review on the application of the DL model in seven F&B domains in Section 4. It is crucial to analyze the feasibility of a DL model toward particular domains. To do so, we provide summarizations in three key aspects, including data preprocessing, data inputs, and evaluation rules, according to our collection of articles. Finally, we determine optimal DL models regarding the identified domains. We further discuss two common issues in using DL models for F&B: overfitting and sustainability.

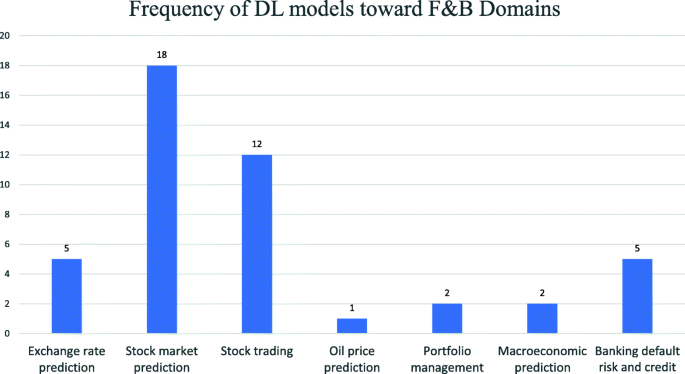

Figure 5 shows that the application domains can be divided into two major areas: (1) banking and credit risk and (2) financial market investment. The former contains two domains: credit risk prediction and macroeconomic prediction. The latter contains financial prediction, trading, and portfolio management. Prediction tasks are crucial, as emphasized by Cavalcante et al. (2016). We study this domain from three aspects of prediction, including exchange rate, stock market, and oil price. We illustrate this structure of application domains in F&B.

Figure 6 shows a statistic in the listed F&B domains. We illustrate the domains of financial applications on the X-axis and count the number of articles on the Y-axis. Note that a reviewed article could cover more than one domain in this figure; thus, the sum of the counts (45) is larger than the size of our review pool (40 articles). As shown in Fig. 6, stock marketing prediction and trading dominate the listed domains, followed by exchange rate prediction. Moreover, we found two articles on banking credit risk and two articles on portfolio management. Price prediction and macroeconomic prediction are two potential topics that deserve more studies.

Based on our review, six types of DL models are reported. They are FNN, CNN, RNN, RL, deep belief networks (DBN), and restricted Boltzmann machine (RBM). Regarding FNN, several papers use the alternative terms of backpropagation artificial neural network (ANN), FNN, MLP, and DNN. They have an identical structure. Regarding RNN, one of its well-known models in the time-series analysis is called LSTM. Nearly half of the reviewed articles apply FNN as the primary DL technique. Nine articles apply LSTM, followed by eight articles for RL, and six articles for RNN. Minor ones that are applied in F&B include CNN, DBM, and RBM. We count the number of articles that use various DL models in seven F&B domains, as shown in Table 1. FNN is the principal model used in exchange rate, price, and macroeconomic predictions, as well as banking default risk and credit. LSTM and FNN are two kinds of popular models for stock market prediction. Differently, RL and FNN are frequently used regarding stock trading. FNN, RL, and simple RNN can be conducted in portfolio management. FNN is the primary model in macroeconomic and banking risk prediction. CNN, LSTM, and RL are emerging research approaches in banking risk prediction. The detailed statistics that contain specific articles can be found in Table 5 in Appendix.

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

Huang, J., Chai, J. & Cho, S. Deep learning in finance and banking: A literature review and classification. Front. Bus. Res. China 14, 13 (2020). https://doi.org/10.1186/s11782-020-00082-6

Anyone you share the following link with will be able to read this content:

Get shareable link

Sorry, a shareable link is not currently available for this article.

Copy to clipboard

Provided by the Springer Nature SharedIt content-sharing initiative